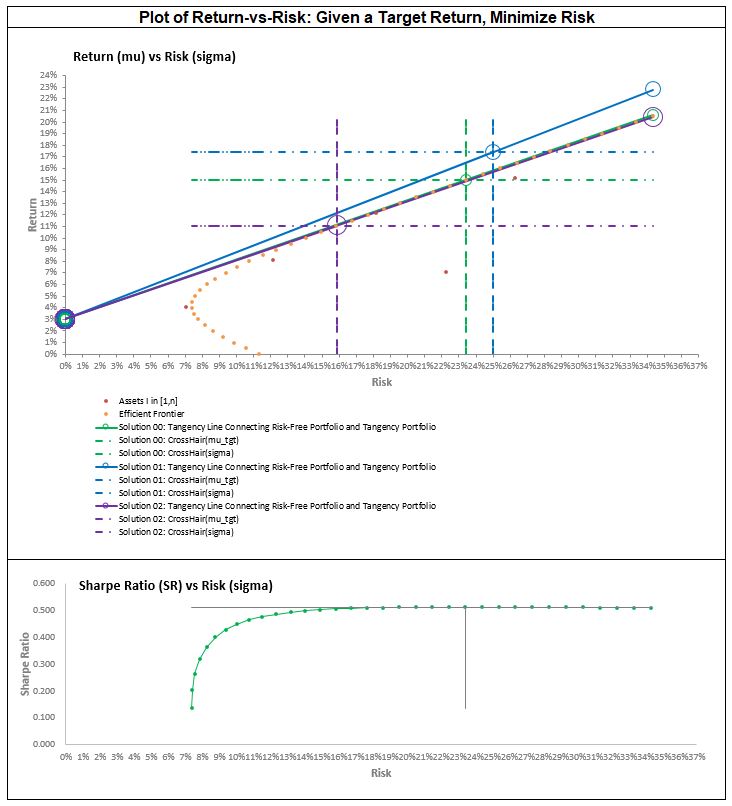

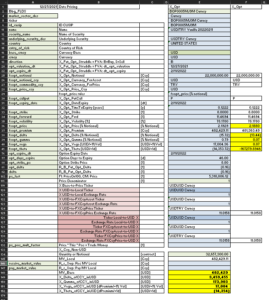

Portfolio Optimization for 20 Securities Using Lagrange Multipliers, No Short-Selling, Weights Sum to 1

Portfolio Optimization for 20 Securities Using Lagrange Multipliers, No Short-Selling, Weights Sum to 1

Problem:

Construct the Optimal Portfolio that:

delivers the target return (mu_Target)

with minimum risk

Minimize the risk of the portfolio (in this case, measured as half the variance)

While maintaining an expected return target of (mu_Target)

By adjusting the investment weights on each asset

Subject to the budget constraint that the weights sum to 1

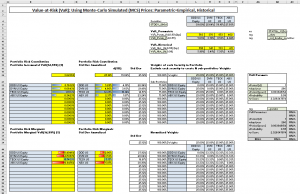

Method:

Since constraints are equalities => We can use Method Lagrange

Supports up to 20 securities.

Able to do more if requested. Please contact us.

Constraints:

No short-selling (ie. No negative weights)

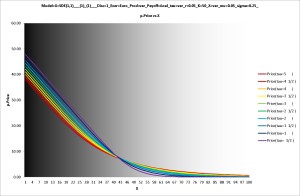

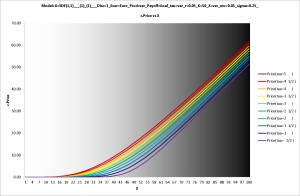

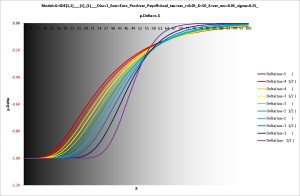

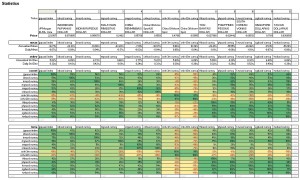

Solution 00:

Basic MPT with only budget constraint that weights sum to 1

Solution 01:

Tweaked solution where no negative weights are allowed,

but budget contraint fails, as sum of weights exceed 1.

Solution 02:

Maintain that no negative weights are allowed,

but normalize weights such that they sum to 1.

This yields a practical solution, but usually unable to meet target return.